FedNow Certification Training

We Help You Create and Manage Your Own FedNow Instant Payments Platform

Welcome to our FedNow Training Service, designed to equip financial institutions with the knowledge and skills needed to implement the FedNow Instant Payments Service internally. Our comprehensive training program offers numerous benefits:

Why Choose Our Training Service?

- In-Depth Knowledge: Gain a thorough understanding of the FedNow system.

- Internal Control: Maintain full control over your implementation process.

- Cost Efficiency: Reduce reliance on external support and maximize savings.

- Customization: Tailor your implementation strategy to your specific needs.

- In-House Expertise: Develop a team of FedNow experts within your organization.

Who Can Participate in FedNow?

Two types of entities are eligible to accept and process FedNow Instant Payments:

- Financial Institutions

- Federal Reserve Bank Service Providers (must qualify as Certified FedNow Service Providers)

FedNow Certification Levels

Financial institutions can choose from various certification levels:

- Receive Only: Accept incoming instant payments

- Send and Receive: Process both incoming and outgoing instant payments

- Send Requests for Payment (Optional): Initiate payment requests

Additionally, all participants must be capable of:

- Performing Liquidity Management Transfers

- Receiving and reviewing various accounting reports

Flexible Implementation Options

Financial institutions have the flexibility to:

- Select their preferred service level(s)

- Use FedLine for certain tasks (connection required)

- Optionally engage a Certified FedNow Service Provider like idebit® for managed Instant Payments services

We're here to guide you through every step of your FedNow journey. Let's work together to bring the power of instant payments to your institution!

FedNow Service Certification Curriculum Overview

Get Set for AI-Powered SUCCESS!

Can't see the forest for the trees? The amount of information to consume on FedNow can seem insurmountable. Much of the terminology is unfamiliar to many. We simplify the process for you using cutting-edge AI technologies. Here's a general outline of our AI-enhanced Instant Payments curriculum. The required tasks fall into the following broad categories: Planning, Intelligent Networking, AI-Powered Messaging, AI-Optimized Applications, Security, Liquidity Transfers and Predictive Reporting.

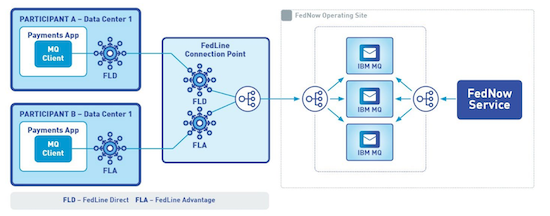

IBM MQ Network Configuration

IBM MQ is a Messaging solution that enables secure, reliable communication between applications and services. The network setup involves configuring the network infrastructure, permissions, and security settings for IBM MQ to ensure proper communication with the FedNow Service.

Plan Network Topology

Design the FedNow Service network to accommodate the IBM MQ architecture, including brokers, queues, and applications.

Install IBM MQ

Configure IBM MQ Network Resources. Establish the necessary IP addresses, ports, and firewall rules to allow communication with FedNow Service servers. Deploy IBM MQ software on your servers.

Establish Queue Managers and Configure Authentication/Permissions

Create and configure queue managers to manage Message queues. Implement secure authentication mechanisms such as TLS to protect communication. Define access controls and grant permissions to users and applications to interact with IBM MQ and the FedNow Service. Perform network connectivity tests and establish monitoring mechanisms to ensure proper network functioning.

FedLine Installation and Usage

FedLine is a secure, online platform provided by the Federal Reserve for accessing various financial services such as the FedNow Service. Installation and usage involve setting up FedLine access, permissions, and using it to manage financial transactions and Messaging.

AI-Powered ISO 20022 Message Generation

ISO 20022 is a global standard for electronic Messaging between financial institutions. Our AI-driven Message generation involves creating and transmitting ISO 20022-compliant Messages like Instant Payments and leveraging natural language processing for enhanced accuracy and efficiency.

AI-Assisted Message Definition, Generation and Data Mapping

Define the content and structure of the ISO 20022 Message based on the specific FedNow Service Instant Payments requirements, aided by our AI algorithms. Develop or configure an AI-powered system to generate ISO 20022 Messages using the Swift platform. Our machine learning models map the data fields from the source system to the corresponding fields in the ISO 20022 Message. AI-driven testing ensures the Message generation process is accurate and complies with the ISO 20022 standard and FedNow Service requirements. Implement AI-powered error handling mechanisms to deal with validation errors and inconsistencies in Message generation.

Message Transmission and Compliance Checks

Set up secure channels for transmitting FedNow Service Messages to the intended recipients.

AI-Enhanced Message Processing Scripts

Our AI-powered Message processing scripts are automated scripts that process incoming and outgoing FedNow Service Messages, validate their contents using machine learning algorithms, and perform necessary actions based on the Message type, all while continuously learning and improving.

Script Development, Message Parsing, Data Processing and Error Handling

Develop scripts to process Messages. Write code to parse incoming Messages, extract relevant information, and validate Message integrity. Perform necessary data transformations, calculations, or lookups based on message content. Implement error handling routines to handle invalid messages, system failures, or communication issues.

Message Formatting, Testing, Monitoring and Maintenance

Format outgoing Messages according to FedNow Service requirements. Test the Message processing scripts with sample data to ensure correct functioning and performance. Set up monitoring tools to track script performance and apply updates or improvements as needed.

Liquidity Management Transfers

Liquidity management transfers refer to the movement of funds between accounts of financial institutions to optimize liquidity, meet reserve requirements, or manage cash flow. Procedures will be delineated during training.

AI-Powered Reporting and Accountability

Our AI-enhanced reporting and accountability involve generating and reviewing FedNow Service reports to track financial transactions, monitor compliance with regulations, and ensure proper management of funds. AI-driven analysis of Fedline data is utilized to access reports and accounting documents, providing deeper insights and predictive analytics.

Get Started with an AI-Powered FedNow Service Implementation Today

Ready to revolutionize your payment infrastructure with AI? Whether you opt for the AI-enhanced training option, an AI-powered managed solution, or a shared approach, getting started with the FedNow Service is easier than ever. Take the leap today and embark on a journey towards seamless, AI-driven Instant Payments. With our dedicated guidance and support, implementing the FedNow Service is within reach. Let's transform the way you do business with the power of artificial intelligence.